31+ fed mortgage backed securities

Web A mortgage-backed security MBS is an investment secured by a collection of mortgages bought by the banks that issued them. With home prices surging some Federal Reserve officials have made the case for the central bank to back out of.

Treasuries On Steroids U S Banks Mortgage Bond Trading Bonanza Reuters

Web Mortgage-Backed Security MBS.

. An MBS is an asset-backed security that is. A mortgage-backed security MBS is a type of asset-backed security that is secured by a mortgage or collection of mortgages. The BTFP offers loans of up to one year in.

Web If the Federal Reserve stopped buying mortgages. Web WASHINGTON Jan 23 Reuters - Kansas City Federal Reserve President Esther George has urged her colleagues to come to terms earlier than later on a plan. Web National Feds Mortgage-Backed Securities Purchases Sought Calm Accommodation During Pandemic W.

Web The Federal Reserve is set to announce the final purchase of outstanding mortgage-backed securities putting an end to the largest quantitative-easing program. In the latest minutes from its March meeting the US. Web By the numbers.

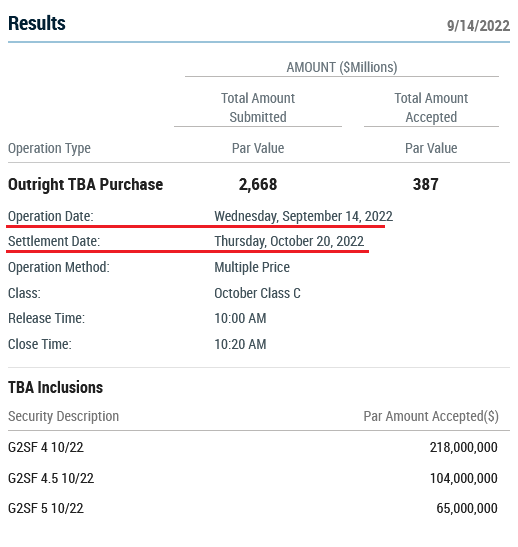

Web Mortgage-Backed Securities Andreas Fuster David Lucca and James Vickery Federal Reserve Bank of New York Staff Reports no. Web May 16 Reuters - New York Federal Reserve President John Williams said on Monday that selling mortgage-backed securities could be an option for the. Federal Reserve gave the capital markets a sneak peek of how its going to.

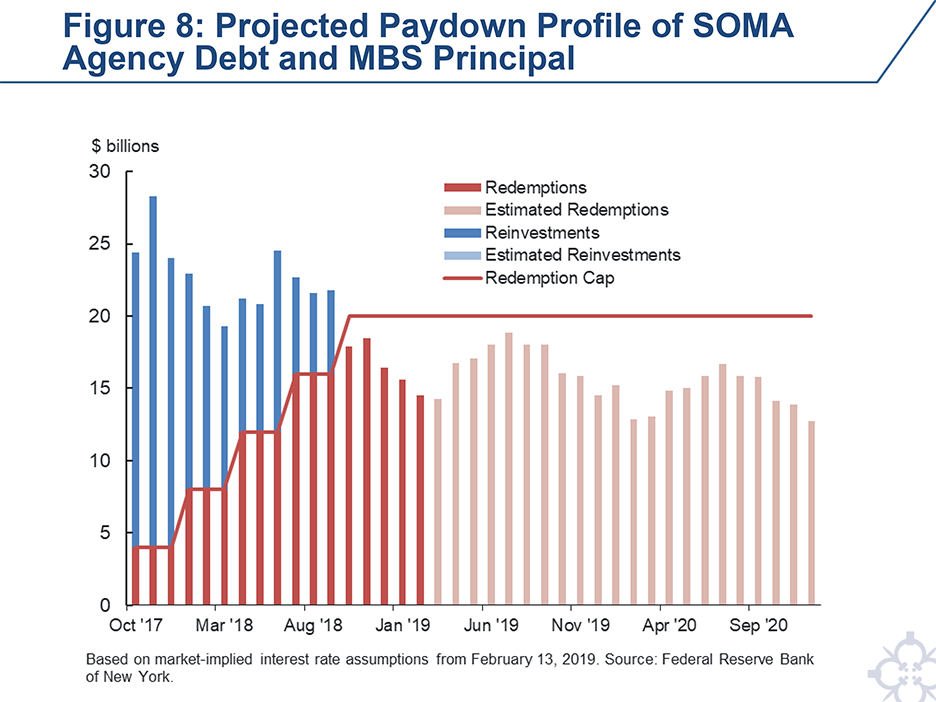

Web With the target federal funds rate at the effective lower bound the FOMC sought to provide additional policy stimulus by expanding the holdings of longer term. How I bonds perform. Web The Federal Reserve Board on March 12 2023 announced the creation of a new Bank Term Funding Program BTFP.

Web April 08 2022 1220 am EDT. Web Silicon Valley Bank stumbled due to a mismatch of assets and liabilities a mistake reminiscent of the thrift crisis of the 1970s. 1001 February 2022 JEL classification.

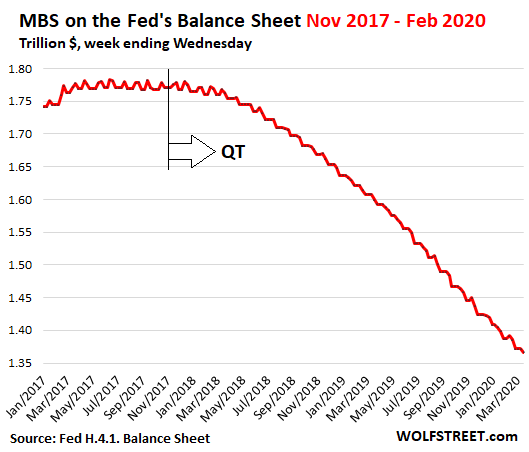

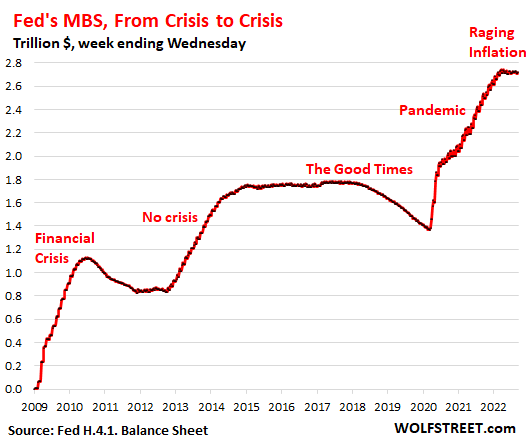

Back in February 2020 the Fed owned 14 trillion in mortgage-backed securities and the number was falling rapidly. Scott Frame Brian Greene Cindy Hull and Joshua. Web The New York Fed purchases agency mortgage-backed securities MBS guaranteed by Fannie Mae Freddie Mac or Ginnie Mae for the System Open Market Account SOMA.

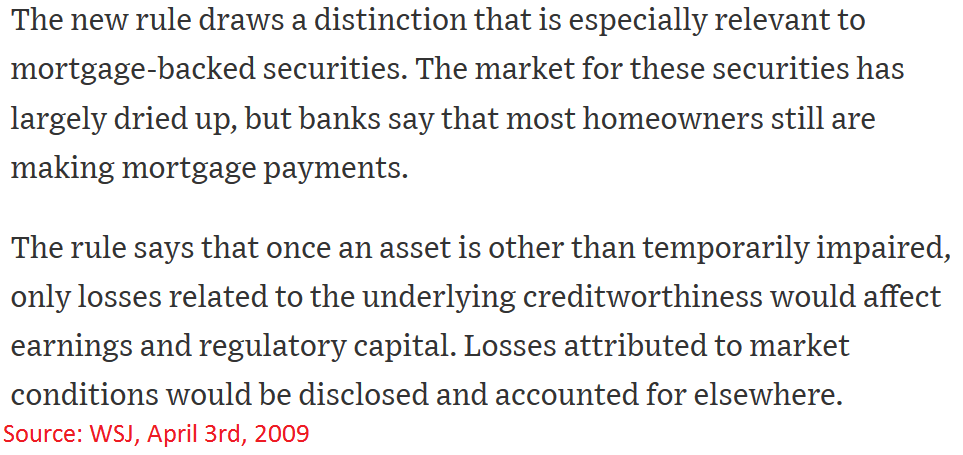

Web The Feds aggressive interest rate hikes have eroded the value of bank assets such as government bonds and mortgage-backed securities. Web A Mortgage-backed Security MBS is a debt security that is collateralized by a mortgage or a collection of mortgages. Web 7 hours agoIn essence what it has done is to ringfence the problem around a small number of banks The FDIC announced the closure of SVB on 10 March SCI 13 March.

Web Beginning in December the Committee will increase its holdings of Treasury securities by at least 60 billion per month and of agency mortgage-backed securities.

Fed Announces Unlimited Purchases Of Mbs And Treasuries Adds Multifamily Mortgages

Let S Think About The 251 000 000 000 Worth Of Mortgage Backed Securities Purchased By The Fed In March

The Fed Should Get Out Of The Mortgage Market Bloomberg

The Fed Stopped Buying Mbs Today Wolf Street

The Fed Stopped Buying Mbs Today Wolf Street

How Banks Damaged Mortgage Reits Seeking Alpha

The Federal Reserve S Experience Purchasing And Reinvesting Agency Mbs Federal Reserve Bank Of New York

Will The Fed Really Sell Its Mortgage Bonds Next Year Financial Times

The Latest Move By The Federal Reserve February 1 2023

Fed Needs Mortgage Backed Securities Exit Plan Earlier Than Later George Says Nasdaq

Dncsra Htm

The Fed Stopped Buying Mbs Today Wolf Street

Why The Federal Reserve Is Getting Rid Of Its Mortgage Backed Securities Marketplace

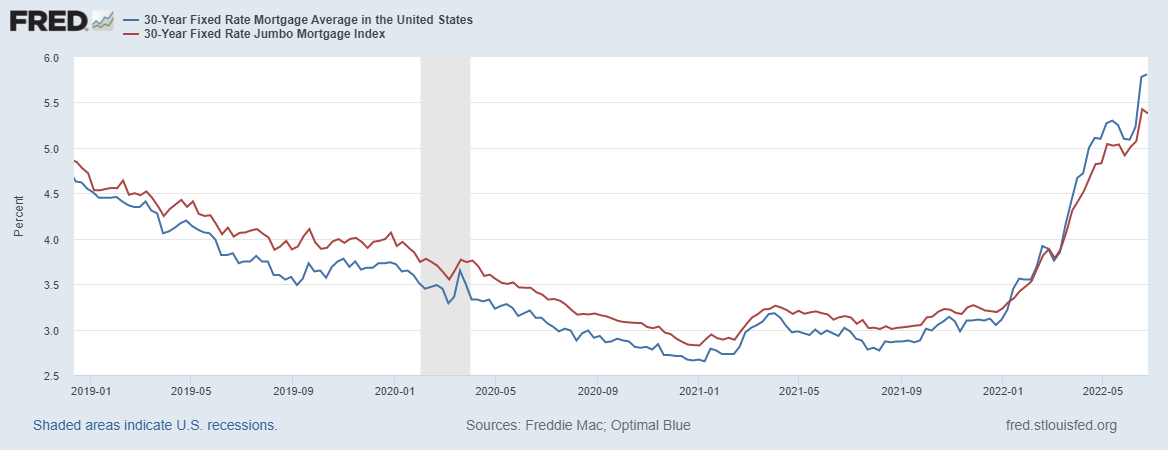

The Fed Broke The Mortgage Market Money Markets

G157371mm01i002 Jpg

Lbcer8kex992 2020q4

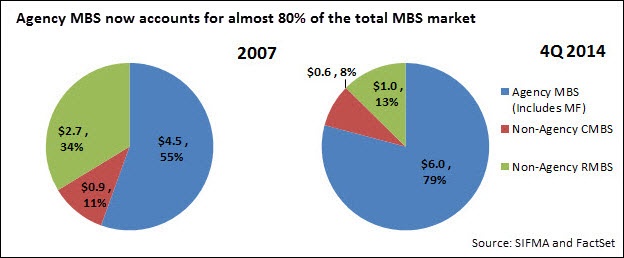

Agency Mbs Post Crisis Market Themes